If you travel to mainland China 10 years from now, you will see

more commercial autonomous vehicles operating on public roads than

anywhere else in the world. That's an estimate based on the

mainland Chinese government's focus to build a regulatory and

economic environment for companies developing these cutting-edge

technologies to survive and thrive.

The current enthusiasm for autonomous vehicles in mainland China

is quite different from Europe and North America, where developers

of such vehicles are contending with cost cuts, consumer apathy and calls for more regulation.

For one, investment in smart infrastructure is a key focus area of

the mainland Chinese government, both at the local and federal

levels. From pilot projects to construct smart connected roads to

issuing permits for the public testing autonomous driving

technologies, mainland China is moving faster than many other

countries on policy and investments.

What's the latest? Mainland China's capital city recently released the “Beijing Autonomous Driving

Vehicle Regulations” aimed at establishing a comprehensive

framework for the management, innovation and development of

autonomous vehicles. The proposed regulation, the biggest

initiative by the city since it first allowed road tests of

autonomous vehicles in 2019, aspires to spark technological

breakthroughs in core areas, including sensors, semiconductors, and

software.

Mainland China's regulatory approach involves a combination of

national standards and government directives designed to accelerate

the development and deployment of autonomous vehicles. The Ministry

of Industry and Information Technology (MIIT) and other agencies

have issued several standards, such as “Guidelines on Establishing

National Standards System of Telematics Industry” and

“Administrative Provisions on Road Testing of Intelligent Connected

Vehicles” to create a supportive environment for testing and

commercializing autonomous vehicles across various cities, enabling

rapid progress and extensive data collection.

Technology adoption trends

Mainland China is already a leader in the Level 2+ segment,

which is projected to grow at a compound annual growth rate (CAGR)

of 39% by 2030. This growth is fueled by the increasing adoption of

advanced sensor hardware and application software in vehicles, as

well as improvements in electric/electronic (E/E) architectures and

over-the-air updates.

The mainland Chinese government's approval of Tesla's Full

Self-Driving (FSD) feature highlights a strong willingness to

elevate autonomous vehicle technology. Tesla's entry into the

mainland Chinese market with its FSD feature, developed in

collaboration with Baidu for mapping, will intensify competition

among domestic and international players. This competitive pressure

is likely to spur further innovation and expansion in the

sector.

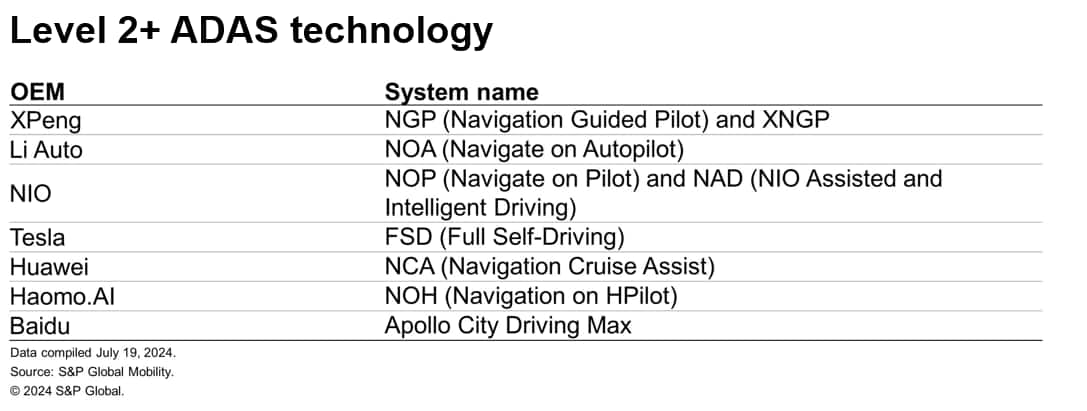

Several mainland Chinese companies have announced plans to roll

out Navigation on Autopilot (NOA) systems across multiple cities.

NOA systems are similar to Tesla's FSD, offering advanced

driver-assistance capabilities such as autonomous stopping,

steering, and lane-changing in urban environments. However, these

systems still require human drivers to monitor and take control

when necessary, classifying them as Level 2+ advanced driver

assistance systems (ADAS).

By the end of this decade, Greater China is expected to emerge

as the largest market for Level 3 and Level 4 vehicles as well.

According to S&P Global Mobility, Greater China would likely

account for more than 60% of global Level 3 vehicle output by 2030,

followed by Europe (nearly 24%) and North America (nearly 13%). For

global Level 4 vehicle output, Greater China's share could reach

over 70% by 2030 followed by North America (16%) and Europe

(11%).

Mainland China still faces challenges related to regulatory

barriers such as clear guidelines and standards, data collection

and privacy, and urban complexity and infrastructure development.

However, its stronger push toward autonomous driving, supported by

substantial government initiatives, investments, and regulatory

frameworks, bode well for the future of autonomous vehicle industry

in the country.

Authored by: Rohan Hazarika, Senior Research

Analyst, Supply Chain & Technology, S&P Global Mobility

Commercials Cooperation Advertisements:

(1) IT Teacher IT Freelance

立刻註冊及報名電腦補習課程吧!

电子计算机 -教育 -IT 電腦班” ( IT電腦補習 ) 提供一個方便的电子计算机 教育平台, 為大家配對信息技术, 電腦 老師, IT freelance 和 programming expert. 讓大家方便地就能找到合適的電腦補習, 電腦班, 家教, 私人老師.

We are a education and information platform which you can find a IT private tutorial teacher or freelance.

Also we provide different information about information technology, Computer, programming, mobile, Android, apple, game, movie, anime, animation…

(2) ITSec

www.ITSeceu.uk

Secure Your Computers from Cyber Threats and mitigate risks with professional services to defend Hackers.

ITSec provide IT Security and Compliance Services, including IT Compliance Services, Risk Assessment, IT Audit, Security Assessment and Audit, ISO 27001 Consulting and Certification, GDPR Compliance Services, Privacy Impact Assessment (PIA), Penetration test, Ethical Hacking, Vulnerabilities scan, IT Consulting, Data Privacy Consulting, Data Protection Services, Information Security Consulting, Cyber Security Consulting, Network Security Audit, Security Awareness Training.

Contact us right away.

Email (Prefer using email to contact us):

SalesExecutive@ITSec.vip