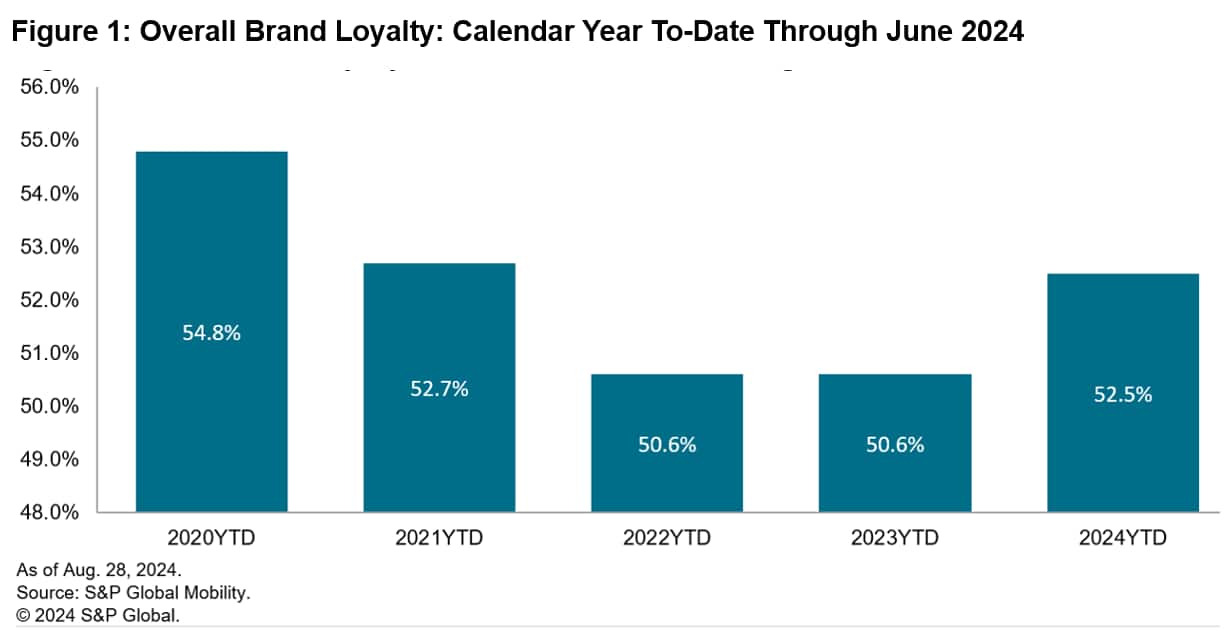

Industry brand loyalty rates trended upward in the first half of

2024 following several years of flat or declining values, according

to a new S&P Global Mobility analysis of new vehicle

registration data through the first half of the year.

The industry's brand loyalty rate through June stands at 52.5%,

reflecting a 1.9 percentage-point improvement over the same period

in 2023, marking the first year-over-year increase since 2020. The

year-over-year increase in loyalty is a positive sign for the

industry after several years of lower loyalty levels due to

inventory shortages and post-pandemic recovery.

More than half of all brands in the industry saw a

year-over-year increase of 1 percentage point or better. This group

included both mainstream and luxury brands, which saw increases of

1.9 and 1.4 percentage points, respectively. Growing inventory

levels and a strong pipeline of return-to- market households were

the primary factors in loyalty gains for the first half of

2024.

“Last year we saw a big jump in the number of households

returning to market for a new vehicle, but the inventory was

lacking,” said

Vince Palomarez, associate director, loyalty product management

at S&P Global Mobility. “This year, return-to-market volume

remains consistent; however, inventory levels are up more than 40%,

so households have more opportunity to remain loyal to their

previous brand.”

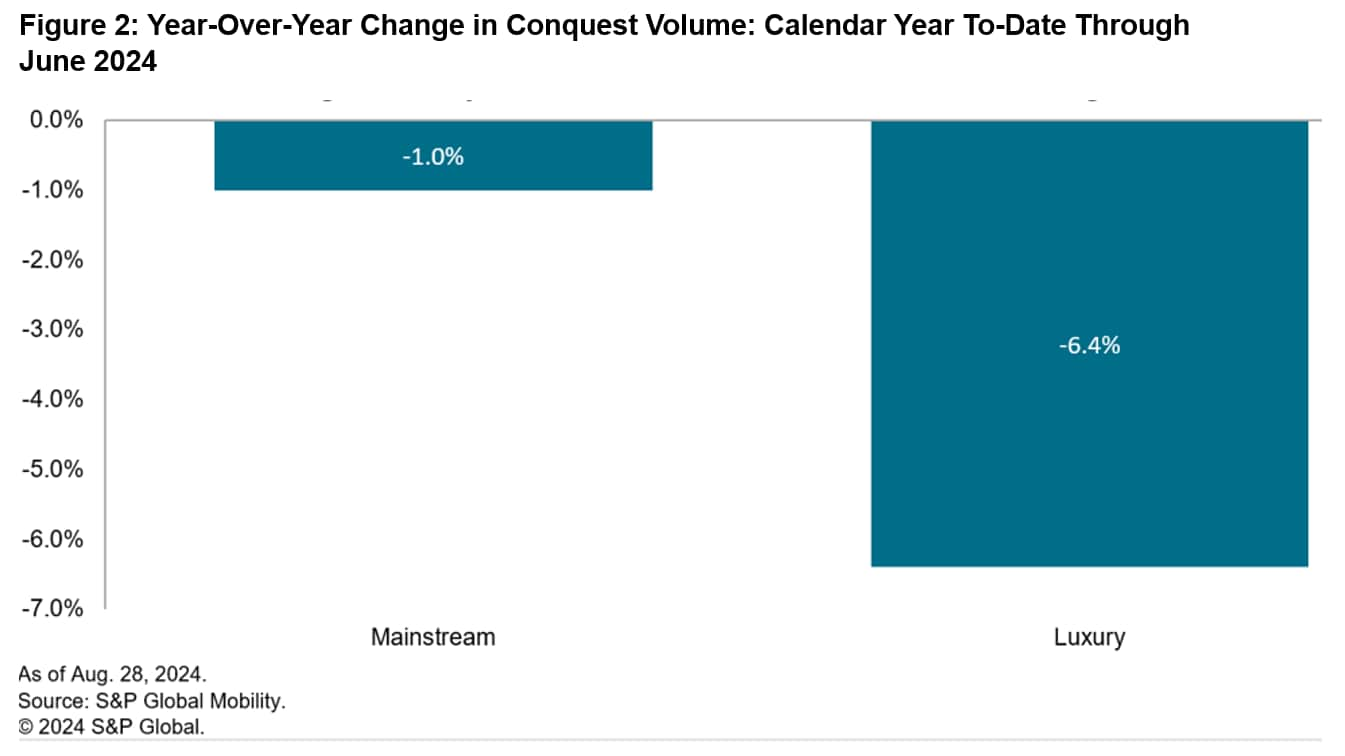

Conquest trends adversely affected

The increase in brand loyalty adversely affected conquest

volume, as both sectors experienced year-over-year declines in the

first half compared to the same period last year. The luxury

brands, which experienced an 18% year-over-year increase for the

first half of 2023, faced the largest decline, dropping 6.4% in the

first half of 2024. Meanwhile, mainstream brands, while still

declining year over year, saw conquest levels fall 1% vs. the first

half of 2023.

“The positive jump in loyalty came at the expense of conquests,”

said

Tom Libby, associate director for loyalty solutions and

industry analysis at S&P Global Mobility. “Past years have

shown that increases in both loyalty and conquests are possible if

the pool of return-to-market rises as well. The first half of 2024

showed little-to-no change in return to market, so either loyalty

or conquest were going to be affected.”

Among individual brands, Tesla continues its run as the leader

in brand loyalty with a rate of 67.8% for the first half of 2024.

While all Tesla models retain more than 60% of their previous

owners, the Model 3 remains the leader in the brand's lineup with a

loyalty rate of 72.1%.

“Tesla has historically been a brand with strong loyal ties

among their consumer base, despite a limited product portfolio,”

said Palomarez. “Changes in BEV prioritization among other OEMs,

along with Tesla's directive to cut pricing when needed, has kept

households from defecting.”

Additional mid-year highlights:

- General Motors leads all multi-brand manufacturers in

manufacturer loyalty for the first half of 2024, at 67.7%. - Jaguar, Land Rover, and Lincoln are among the highest

year-over-year gainers in brand loyalty, each improving rates by

more than 6 percentage points. - The Lincoln Nautilus is the current leader in model loyalty at

46.7%.

Get more details on our mid-year analysis by

watching our loyalty webinar. Webinar is available live

[August 29 at 1 pm ET] or on demand.