Listen

to this Fuel for Thought podcast.

Mainland China's transition to electrification reached a major

milestone in July 2024 when sales of new-energy vehicles (NEVs)

surpassed internal combustion engine (ICE) vehicles for the first

time, according to data released by the China Passenger Car

Association (CPCA).

NEVs include battery electric vehicles (BEVs), plug-in hybrid

vehicles (PHEVs) and range-extended electric vehicles (REEVs). In

2023, automakers' aggressive sales promotions and a tidal wave of

new model launches helped to boost sales of NEVs in mainland China

after the 2022 withdrawal of the central-government subsidy

programs.

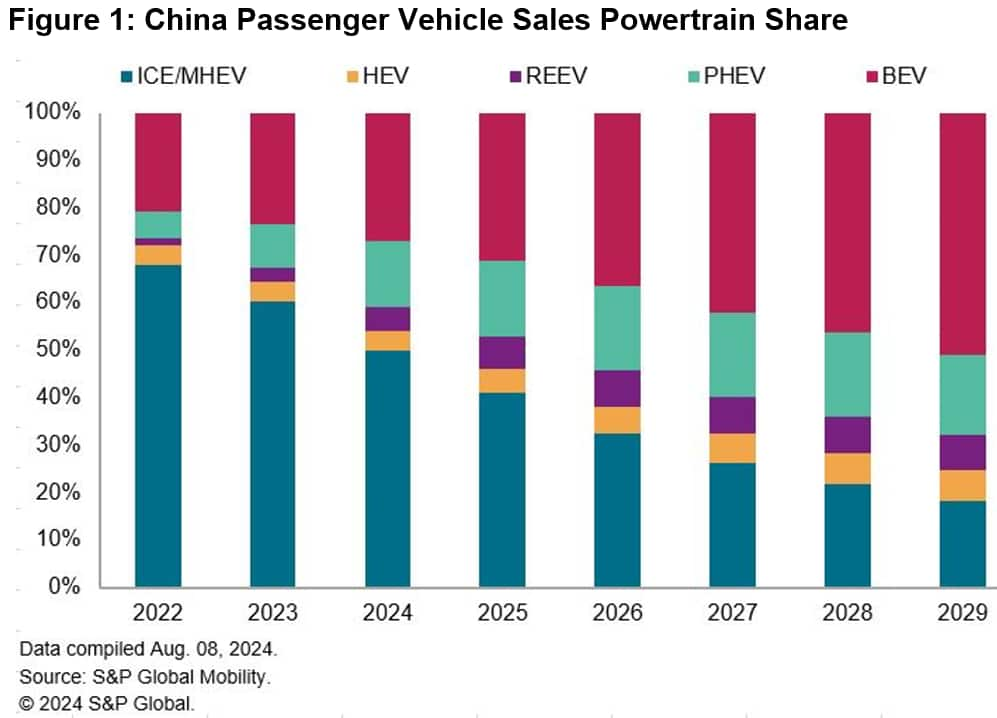

It is beyond doubt that the Chinese auto market will continue to

transition to electric vehicles in the next few years with

automakers advancing their electrification plans. S&P Global

Mobility expects that NEV share of the Chinese passenger vehicle

market will reach 46% in 2024, compared to 36% in 2023.

The acceleration in the market's shift to EVs will be helped by

declining battery prices, a wider availability of models and the

intense level of competition that exists in the market.

With NEVs going mainstream, trends taking shape in the sector

have begun to affect the broader passenger car market and influence

consumer choices.

EV adoption increasingly driven by plug-in hybrid

models with BEV sales slowing down

Although purchases of BEVs, PHEVs and REEVs are all eligible for

the central-government's purchase tax reduction incentive programs

through 2027, what is really accelerating the market's shift to

electrification in 2024 are PHEVs and REEVs, rather than pure

electric vehicles.

In the first half of 2024, Chinese sales of BEVs rose by 12%

year over year to 3.02 million units, by comparison, sales of

PHEVs, including vehicles with extended-range electric powertrain,

surged by 85% year over year to 1.92 million units in the first

half of this year.

These market dynamics were already taking shape in 2023. S&P

Global Mobility research shows that combined sales volumes of PHEVs

and REEVs in the passenger vehicle market surged by 83% year over

year in 2023 to 2.75 million units, while that of BEVs grew by 20%

to 5.2 million units.

S&P Global Mobility expects PHEV and REEV sales in mainland

China to continue to grow in the next few years, accounting for 24%

of total passenger vehicle sales by 2029. Despite a slowdown in the

annual growth rate, BEV sales share is expected to reach 51% in

2029. Together, the total NEV sales share would be 75% that year,

according to S&P Global Mobility forecasts.

Growing presence of Chinese automakers poses a

challenge for global companies

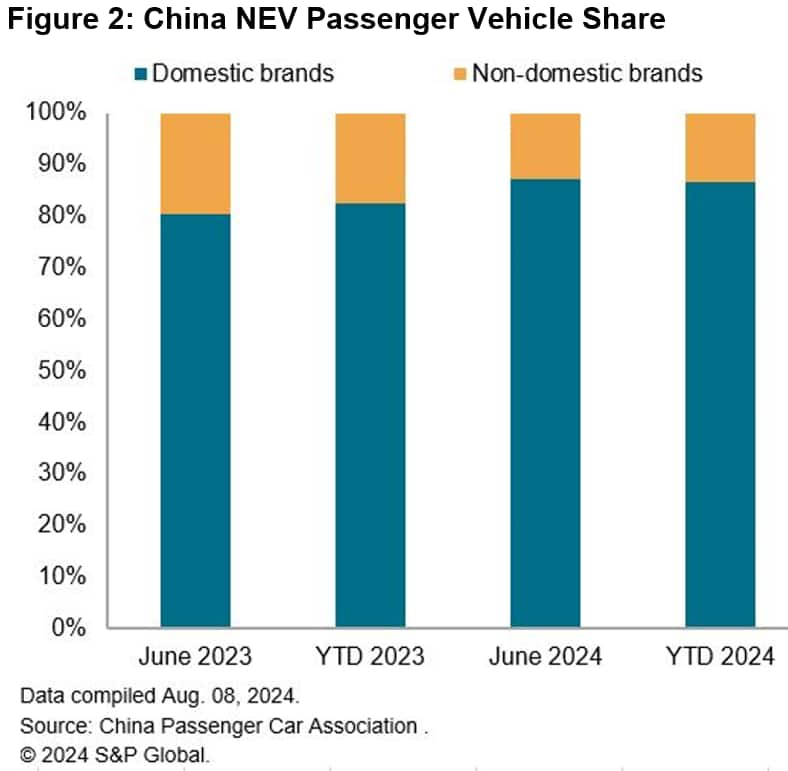

Chinese brands' strong presence in the NEV market has helped

them to advance their market share in the overall passenger vehicle

market. Domestic brands' market share in the Chinese retail

passenger NEV market increased from 83% in the first half of 2023

to 87% in the first half of 2024, while their global counterparts

have a combined sales share of less than 15% in the first six

months of 2024.

Chinese OEMs' growing presence in the NEV market has led to a

shift in consumer preferences over brands and models. Global OEMs,

especially the Japanese brands, have struggled to match their

Chinese rivals in the speed of adapting to changing consumer demand

and market conditions. Toyota has already cut production at its

Chinese JVs by 22% year over year in the first half of 2024 to cope

with declining demand. Nissan and Honda, the other two major

Japanese automakers in mainland China, have all recorded huge

declines in Chinese sales during 2024, faced with BYD's aggressive

product offensive.

In addition, the premium automakers, including the big 3 German

brands, also face the challenge of commanding a price premium for

their new-generation BEVs as price competition intensifies. To keep

up with the speed of innovation in China and reduce development

costs, VW is working with Xpeng and SAIC Motor on separate EV

programs that will use the two Chinese companies' vehicle platforms

and software technologies. VW's upcoming new launches in mainland

China will also include long-range PHEVs and REEVs developed

jointly with SAIC.

S&P Global Mobility's latest projection shows Chinese

brands' sales share in the country's passenger NEV market is set to

reach 87% in 2024, further improving from 83% in 2023. With global

automakers rolling out their new-generation BEVs and PHEVs in

mainland China in the next few years, we expect global brands'

market share to improve from 2026 onwards to reach 25% in 2029 with

VW and BMW contributing strongly.

Chinese tech companies tapping into consumer

preferences for SDVs

Software is increasingly a point of difference in influencing

buying choice in mainland China. Growing consumer interest in

software-defined vehicles (SDVs) presents an opportunity for

mainland China's tech companies to tap into the electric vehicle

market.

Xiaomi Corporation, a leading smart phone manufacturer, aims to

deliver 100,000 EVs this year. The company's first electric model,

the SU7 sedan, has received unprecedented publicity in mainland

China thanks to Xiaomi's strong brand appeal, its huge consumer

electronics products userbase and new smart car features it

introduced to the SU7.

China's telecom giant Huawei also emerged as a major player in

the NEV sector, providing a range of intelligent vehicle

technologies to its OEM partners. The success of AITO, a

Huawei-backed NEV brand, has encouraged China's state-backed

automakers including BAIC and JAC to forge partnerships with Huawei

to transition their product line with software-defined cars.

China's export surge met with new trade

barriers

Although electrification in mainland China continues to grow,

the country's status as an EV production and export hub may face

some challenges.

Mainland China's EV exports surged in the past two years amid

automakers' efforts to expand sales in global markets. Data from

the China Association of Automobile Manufacturers (CAAM) suggests

China's NEV exports reached 1.2 million units in 2023, compared

with less than 680,000 units in 2022.

Although Tesla contributed largely to mainland China's EV export

surge in recent years, growing EV shipment volumes of Chinese

automakers including SAIC and BYD has fueled concerns over China's

overcapacities and its intention to dominate the global market with

low-price vehicles.

The EU's provisional tariffs, which adds up to 36.3% of custom

duties to Chinese-built BEVs, are the latest example of rising

protectionist actions taken by major economies to protect their

market from the influx of BEVs originating in China. Canada and the

US have also announced strict tariffs on China-made BEVs.

Automakers are looking to cope with these trade barriers by

shifting production of certain models to other manufacturing

locations or investing in local production capacities to circumvent

tariffs. The high tariffs will also prompt automakers to further

optimize their cost structure to maintain a reasonable margin

level.

However, within the automotive sector, major global automakers

including Stellantis and Volkswagen are seeking their own way to

keep up with competition from Chinese rivals. Both automakers have

invested in Chinese EV startups in the past year to gain access to

EV know-hows—especially software architecture—and speed up

new launches. The Stellantis and Leapmotor joint venture already

began shipment of Leapmotor EVs built in mainland China to Europe

in July.

To cope with the EU tariffs, Stellantis also kicked off assembly

of the Leapmotor T03 EV at its plant in Poland from

semi-knocked-down kits imported from mainland China.

S&P Global Mobility offers detailed sales-based

powertrain forecasts for the United States, Canada, Brazil, United

Kingdom, Italy, Germany, France, Spain, Netherlands, Sweden,

Norway, Rest of EU30, India, mainland China, and Australia.